Printable 2015 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2015 tax tables, and instructions for easy one page access. For most US individual tax payers, your 2015 federal income tax forms were due on April 18, 2016 for income earned from January 1, 2015 through December 31, 2015.

2015 Form 1040: U.S. Individual Income Tax Return 2014 Inst 1040: Instructions for Form 1040, U.S. Individual Income Tax Return 2014 Form 1040: U.S. Individual Income. Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2016 Form 1040-NR: U.S. Nonresident Alien Income Tax Return 2015 Inst 1040-NR: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2015 Form 1040-NR. Individual Income Tax Return: Instructions for Form 1040, U.S. Individual Income Tax Return: Tax Table and Tax Rate Schedules Publications.

1040ez Form 2015 Printable

If you don't know which 2015 federal tax forms to file, please continue reading down this page for instructions. If you do know, click one of the three IRS form titles below to skip ahead.

You generally have up to three years to claim your 2015 federal income tax refund. There is no statute of limitations for assessing and collecting 2015 federal income tax due if no return has been filed (a good reason to always file a return). Penalties and interest may accumulate each day that you are late paying your federal income tax due. So don't delay, file your 2015 federal tax forms as soon as you can. If you can't afford to pay the back taxes you owe, call the IRS to ask for a reduction due to a hardship, or, create a payment schedule. See the 2015 Form 1040 instructions booklet below for more information.

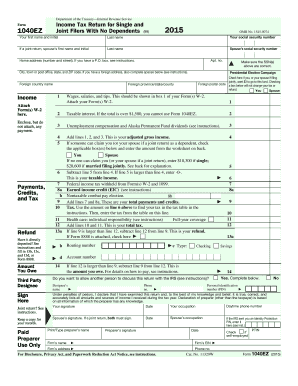

2015 Form 1040EZ - Easy Form

Print 2015 federal income tax forms and instructions for 1040EZ, Form 1040A, and 2015 Form 1040 income tax returns. Printable 2015 federal tax forms 1040EZ, 1040A, and 1040 are grouped below along with their most commonly filed supporting IRS schedules, worksheets, 2015 tax tables, and instructions for easy one page access. Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2016 Form 1040-NR: U.S. Nonresident Alien Income Tax Return 2015 Inst 1040-NR: Instructions for Form 1040-NR, U.S. Nonresident Alien Income Tax Return 2015 Form 1040-NR: U.S. Nonresident Alien Income Tax Return 2014.

File federal Form 1040EZ if you met these requirements for 2015:

- Filing status is single or married filing jointly.

- No dependents to claim (children, adults you support).

- You and your spouse were under age 65 and not blind.

- Taxable interest income of $1,500 or less.

- Taxable income is less than $100,000.

- Earnings are from wages, salaries, tips, taxable scholarships or grants, unemployment compensation, Alaska Permanent Fund.

- No deductions for educator expenses, student loan interest, tuition and fees, or itemized deductions.

- No credits for education, retirement savings, or health coverage.

- No advance earned income credit (EIC) received.

- You CAN claim the earned income credit (EIC) using this form.

If you did not meet the above minimum Form 1040EZ requirements for tax year 2015, please continue down this page to IRS Form 1040A next.

2015 Form 1040EZ

2015 Form 1040EZ Instructions

2015 Form 1040EZ Tax Table

Supporting forms and schedules:

1040V - Payment Voucher

8888 - Allocation of Refund (Bond, Direct Deposit, Paper Check)

8965instructions - Health Coverage Exemptions

9465instructions - Installment Agreement Request

Click any of the 2015 1040EZ form links above to view, print, save.

2015 Form 1040A - Short Form

File federal Form 1040A if you met these requirements for 2015:

- Taxable income less than $100,000.

- No itemized deductions, mortgage interest, property tax, etc.

- No capital gain or loss, no other gains or losses.

- No business income or loss, self-employed, LLC, etc.

- No farm or fisherman income or loss.

- No rental, royalty, partnership, S corporation, or trust income.

- No alimony income received or alimony paid.

- No household employment taxes.

- All filing statuses are allowed.

- Educator expense, IRA deduction, student loan interest, and tuition and fees gross income adjustments are allowed.

- Credits for child and dependent care expenses, elderly or the disabled, education, earned income credit (EIC), adoption, and retirement savings contributions are allowed.

If you did not meet the above minimum Form 1040A requirements for tax year 2015, please continue down this page to IRS Form 1040 next.

2015 Form 1040A

2015 Form 1040A Instructions

2015 Form 1040A Tax Table

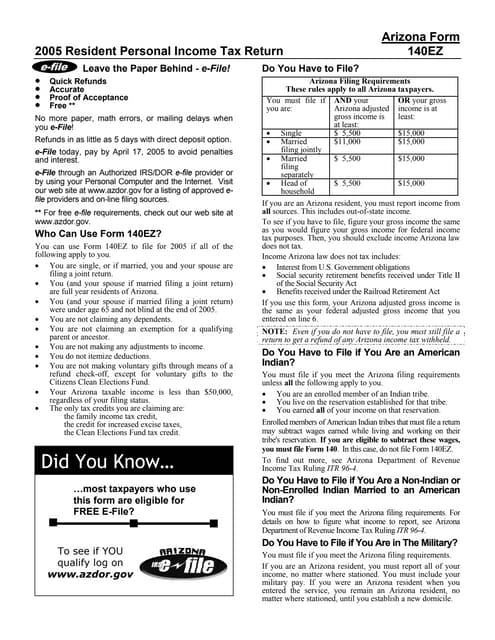

2015 1040ez Instructions

Supporting refund and payment voucher forms:

1040V - Payment Voucher

8888 - Allocation of Refund (Bond, Direct Deposit, Paper Check)

9465instructions - Installment Agreement Request

Other supporting forms and schedules:

Schedule B - Interest and Ordinary Dividends for 1040A

Schedule EIC - Earned Income Credit (EIC) Qualifying Child

Schedule Rinstructions - Credit for the Elderly or the Disabled

2210instructions - Underpayment of Estimated Tax

2441instructions - Child and Dependent Care Expenses for 1040A

8606instructions - Nondeductible IRAs

8615instructions - Tax for Children With Unearned Income

8812instructions - Child Tax Credit (Schedule 8812)

8814 - Parents' Election To Report Child's Interest and Dividends

8815 - Exclusion of Interest From Series EE and I US Savings Bonds

8839instructions - Qualified Adoption Expenses

8862 - Claim Earned Income Credit (EIC) After Disallowance

8863instructions - Education Credits (Opportunity, Learning)

8880 - Credit for Qualified Retirement Savings Contributions

8917 - Tuition and Fees Deduction

8958 - Allocation of Tax Amounts Between Certain Individuals

8959instructions - Additional Medicare Tax

8960instructions - Net Investment Income Tax

8962instructions - Premium Tax Credit (PTC)

8965instructions - Health Coverage Exemptions

Request and application forms:

4506 - Request for Copy of Tax Return

4506-T - Request for Transcript of Tax Return (free copy)

8822 - Change of Address

8857instructions - Request for Innocent Spouse Relief

Click any of the 2015 1040A form links above to view, print, save.

2015 Form 1040 - Long Form

You must file federal Form 1040 for 2015 under these circumstances:

- Failed the Form 1040EZ and Form 1040A requirements.

- Taxable income of $100,000 or more.

- Itemized deductions, interest, property tax, medical, dental, etc.

- Capital gain or loss, other gains or losses.

- Business income or loss, self-employed, LLC, etc.

- Farm or fisherman income or loss.

- Rental, royalty, partnership, S corporation, or trust income.

- Received alimony income or paid alimony.

- Owe household employment taxes.

- Health savings account deduction.

- Have moving expenses to claim.

- Foreign tax credit to claim.

- Residential energy credits.

Any US resident taxpayer can file Form 1040. You do not have to file the shorter Form 1040A or Form 1040EZ.

2015 Form 1040

2015 Form 1040 Instructions

2015 Form 1040 Tax Tables

Supporting refund and payment voucher forms:

1040V - Payment Voucher

8888 - Allocation of Refund (Bond, Direct Deposit, Paper Check)

9465instructions - Installment Agreement Request

Supporting forms and schedules for Households:

Schedule Ainstructions - Itemized Deductions, Form 1040

Schedule B - Interest and Ordinary Dividends

Schedule EIC - Earned Income Credit: Qualifying Child

Schedule Hinstructions - Household Employment Taxes, Form 1040

Schedule Rinstructions - Credit for the Elderly or the Disabled

2441instructions - Child and Dependent Care Expenses

3903 - Moving Expenses

4137 - Social Security and Medicare Tax on Unreported Tip Income

8812instructions - Child Tax Credit (Schedule 8812)

8834 - Qualified Electric Vehicle Credit

8839instructions - Qualified Adoption Expenses

8853instructions - Archer MSA and Long-Term Care Insurance

8862 - Claim Earned Income Credit (EIC) After Disallowance

8863instructions - Education Credits (Opportunity, Learning)

8880 - Credit for Qualified Retirement Savings Contributions

8885instructions - Health Coverage Tax Credit

8889instructions - Health Savings Accounts (HSA)

8917 - Tuition and Fees Deduction

8958 - Allocation of Tax Amounts Between Certain Individuals

8959instructions - Additional Medicare Tax

8962instructions - Premium Tax Credit (PTC)

8965instructions - Health Coverage Exemptions

Supporting forms and schedules for Business, Employee, Farming

Schedule Cinstructions - Profit or Loss From Business

Schedule C-EZ - Net Profit From Business

Schedule Finstructions - Profit or Loss From Farming

Schedule Jinstructions - Averaging for Farmers and Fishermen

Schedule K-1instructions - Partners's Share of Income (Form 1065)

Schedule SEinstructions - Self Employment Tax

2106instructions - Employee Business Expenses

2106-EZ - Unreimbursed Employee Business Expenses

2210instructions - Underpayment of Estimated Tax

4562instructions - Depreciation and Amortization

8829instructions - Expenses for Business Use of Your Home

Supporting forms and schedules for Real Estate, Investing, Other

Schedule Dinstructions - Capital Gains and Losses

Schedule Einstructions - Supplemental Income and Loss

4972 - Tax on Lump-Sum Distributions

4952 - Investment Interest Expense Deduction

5329instructions - Additional Taxes on Qualified Plans

6251instructions - Alternative Minimum Tax

8582instructions - Passive Activity Loss Limitations

8606instructions - Nondeductible IRAs

8615instructions - Tax for Children With Unearned Income

8801instructions - Credit for Prior Year Minimum Tax

8814 - Parent's Election To Report Child's Interest and Dividends

8815 - Exclusion of Interest From Series EE and I US Savings Bonds

8960instructions - Net Investment Income Tax

Request and application forms:

4506 - Request for Copy of Tax Return

4506-T - Request for Transcript of Tax Return (free copy)

8822 - Change of Address

8857instructions - Request for Innocent Spouse Relief

Form 1040, Form 1040A, and Form 1040EZ instructions booklet include the most common worksheets and tables necessary to complete your 2015 IRS income tax return:

2015 Earned Income Credit (EIC) Table

2015 Tax Table

Alternative Minimum Tax Worksheet

Child Tax Credit Worksheet

Earned Income Credit (EIC) Worksheet

IRA Deduction Worksheet

Qualified Dividends and Capital Gain Tax Worksheet

Simplified Method Worksheet

Social Security Benefits Worksheet

Standard Deduction Worksheet for Dependents

Student Loan Interest Deduction Worksheet

All of the 2015 federal income tax forms listed above are in the PDF file format. The IRS expects your 2015 income tax forms to be printed on high quality printers. Most of today's laser and ink jet printers are generally acceptable. You can print your 2015 federal tax forms using the standard mode with black and white or gray scale printing preferences set. No color printing is required. We recommend that you read the first few pages of any Form 1040, Form 1040A or Form 1040EZ filing instructions booklet for updates regarding the printing of your 2015 IRS income tax forms.

More Federal Income Tax Forms, Schedules, Worksheets, Tax Tables, And Instructions Booklet

Even more printable federal tax forms, supporting schedules, calculation worksheets, tax tables, payment vouchers, and instructions booklet are grouped by form (1040, 1040A, 1040EZ) and by tax year on the pages listed below:

2019 Tax Forms

2018 Tax Forms

2017 Tax Forms

2016 Tax Forms

Please report any broken 2015 federal tax form and instructions booklet links using our contact us page found at the bottom of this page.

Reference: Form 1040, Form 1040A, Form 1040EZ, 2015 Forms and Instructions, published by the Department of the Treasury Internal Revenue Service IRS.

Last updated: September 12, 2019

1040EZ 2015 Printable PDF Files:

Update: 2015 1040EZ Form and 2015 1040EZ Instructions links above are the correct links to use as of March 7, 2017. This is a popular but outdated post so we wanted you to know. You can find more 2015 Forms and Instructions on our 2015 1040 Form page.

The IRS has updated and published the 1040EZ 2015 Instructions Booklet PDF. This income tax filing season the IRS published the 1040EZ 2015 Form on December 17, 2015, however, the instructions booklet was delayed until January 6, 2016. Use the 1040EZ 2015 printable PDF file links above to view, save, and print the income tax form and instructions booklet for free.

Inside the 1040 2015 Instructions Booklet you will find:

- Checklist for using Form 1040EZ.

- Line instructions for Form 1040EZ.

- Earned Income Credit (EIC) instructions.

- Mailing address for where to send your forms.

- IRS income tax table for 2015.

The IRS will not begin processing paper or electronically filed income tax returns until January 19, 2016. You can print, fill-in, and mail your 1040EZ form before this date. Keep in mind, however, that Forms W-2 from employers, Forms 1099 from banks and sub-contract work, and other important tax documents are generally not due to you until February 1, 2016.

Not a Form 1040EZ filer? You can obtain the printable PDF files for Form 1040A and long form Form 1040 here.

Last updated: March 7, 2017