(a) Application for and Order of Employment. An order approving the employment of attorneys, accountants, appraisers, auctioneers, agents, or other professionals pursuant to §327, §1103, or §1114 of the Code shall be made only on application of the trustee or committee. The application shall be filed and, unless the case is a chapter 9 municipality case, a copy of the application shall be transmitted by the applicant to the United States trustee. The application shall state the specific facts showing the necessity for the employment, the name of the person to be employed, the reasons for the selection, the professional services to be rendered, any proposed arrangement for compensation, and, to the best of the applicant's knowledge, all of the person's connections with the debtor, creditors, any other party in interest, their respective attorneys and accountants, the United States trustee, or any person employed in the office of the United States trustee. The application shall be accompanied by a verified statement of the person to be employed setting forth the person's connections with the debtor, creditors, any other party in interest, their respective attorneys and accountants, the United States trustee, or any person employed in the office of the United States trustee.

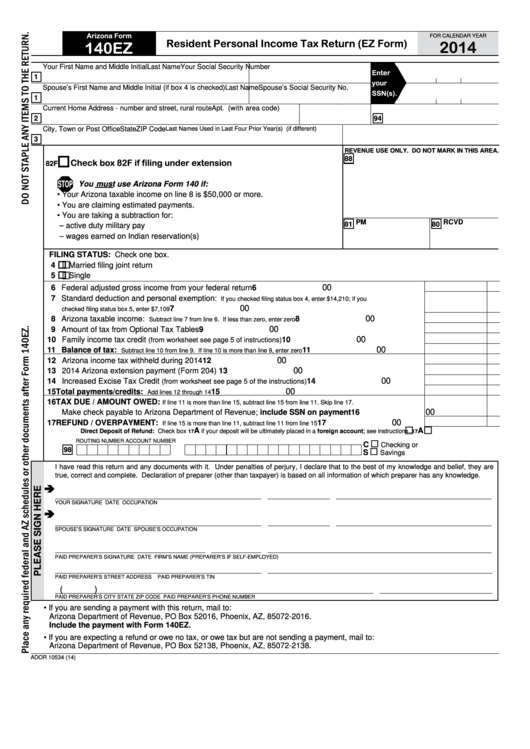

Personal income tax return filed by full-year resident taxpayers. You may use Form 140EZ if all of the following apply: You are single, or if married, you and your spouse are filing a joint return. Your taxable income is less than $50,000 regardless of your filing status. Arizona form 140ez. Arizona form 2014 individual amended income tax return 140x. 2014 massachusetts personal income tax forms and instructions. Income tax forms. Activities that include arizona form 140ez instruction booklet account help and more prospective students admissions brochure student handbook fees structure per programme student corporate email account help student joining instructions 2018 2019 kenyatta university calendar kenyatta university catalogue 2014 2017 kenyatta university. Use this step-by-step guide to complete the Arizona 2014 140ez form quickly and with ideal accuracy. The way to complete the Online 140ez on the internet: To begin the document, utilize the Fill & Sign Online button or tick the preview image of the blank. The advanced tools of the editor will guide you through the editable PDF template. . Your Arizona taxable income is less than $50,000. This Booklet Contains:. Form 140EZ – Resident Personal Income Tax Return. Form 204 – Extension Request Do not file Form 140EZ if you are an active duty member of the U.S. If you are an active duty member of the U.S. Armed Forces, you may subtract all active duty.

(b) Services Rendered by Member or Associate of Firm of Attorneys or Accountants. If, under the Code and this rule, a law partnership or corporation is employed as an attorney, or an accounting partnership or corporation is employed as an accountant, or if a named attorney or accountant is employed, any partner, member, or regular associate of the partnership, corporation, or individual may act as attorney or accountant so employed, without further order of the court.

Notes

(As amended Mar. 30, 1987, eff. Aug. 1, 1987; Apr. 30, 1991, eff. Aug. 1, 1991.)

Notes of Advisory Committee on Rules—1983

Subdivision (a) is adapted from the second sentence of former Bankruptcy Rule 215(a). The remainder of that rule is covered by §327 of the Code.

Subdivision (b) is derived from former Bankruptcy Rule 215(f). The compensation provisions are set forth in §504 of the Code.

Notes of Advisory Committee on Rules—1991 Amendment

This rule is amended to include retention of professionals by committees of retired employees pursuant to §1114 of the Code.

The United States trustee monitors applications filed under §327 of the Code and may file with the court comments with respect to the approval of such applications. See 28 U.S.C. §586(a)(3)(H). The United States trustee also monitors creditors’ committees in accordance with 28 U.S.C. §586(a)(3)(E). The addition of the second sentence of subdivision (a) is designed to enable the United States trustee to perform these duties.

Subdivision (a) is also amended to require disclosure of the professional's connections with the United States trustee or persons employed in the United States trustee's office. This requirement is not intended to prohibit the employment of such persons in all cases or to enlarge the definition of “disinterested person” in §101(13) of the Code. However, the court may consider a connection with the United States trustee's office as a factor when exercising its discretion. Also, this information should be revealed in the interest of full disclosure and confidence in the bankruptcy system, especially since the United States trustee monitors and may be heard on applications for compensation and reimbursement of professionals employed under this rule.

The United States trustee appoints committees pursuant to §1102 of the Code which is applicable in chapter 9 cases under §901. In the interest of full disclosure and confidence in the bankruptcy system, a connection between the United States trustee and a professional employed by the committee should be revealed in every case, including a chapter 9 case. However, since the United States trustee does not have any role in the employment of professionals in chapter 9 cases, it is not necessary in such cases to transmit to the United States trustee a copy of the application under subdivision (a) of this rule. See 28 U.S.C. §586(a)(3)(H).

How to file your Arizona taxes

Do you live in Arizona? Then you probably know how complicated is to file taxes here. Some would say that Arizona Form 140 works well as a fictional character to scare the children who don’t want to go to bed at night. But don’t worry; we’re here to scare away all your fears when it comes to filling your tax returns with Arizona.

Arizona considers capital income as normal income, but you are taxed on some categories of income that you have to mention on your return (for example interest from municipal bonds bought from outside Arizona).

Online Tax Software: Compare Them Here

How about escaping all the hassle of filing your taxes this year? Why not let the computer do it for you? There are great options out there, which more and more Americans are using: e-File.com and Credit Karma. Check now our detailed information to see what their pros and cons are and make your best choice!

e-File.com also offers FREE state income tax filing for Arizona, so make sure to check if you’re eligible.

- Fast Refund

- Pricing

- Ease of Use

- Accuracy

- Phone Support

- Local Support

- FREE Audit Support

Arizona Tax Forms

- Arizona Tax Booklet - Arizona Resident Personal Income Tax Booklet

- Arizona Form 140X - Arizona Individual Amended Income Tax Return

- Arizona Form 140ES - Arizona Individual Estimated Tax Payment

- Arizona Form 140PY Schedule A (PYN) - Arizona Itemized Deductions for Part-Year Resident with Nonresident Income

- Arizona Form 140-IA - Arizona Individual Income Tax Installment Agreement Request

- Arizona Form 221 - Arizona Underpayment of Estimated Tax by Individuals

- Arizona Form 140PY Schedule A (PY) - Arizona Itemized Deductions Part-Year Resident

- Arizona Form AZ-140V - Arizona Individual Income Tax payment Voucher for Electronic Filing

- Arizona Form 140PTC - Arizona Property Tax Refund Claim Credit

- Arizona Form 301 - Arizona Nonrefundable Individual Tax Credits and Recapture

- Arizona Form 140 Schedule A - Arizona Itemized Deduction Adjustments

- Arizona Form 140A - Arizona Individual Resident Income Tax Return (Short)

- Arizona Form 140NR - Arizona Individual Non-resident Income Tax Return

- Arizona Form 309 - Arizona Credit for Taxes Paid to Another State or Country

- Arizona Form 140 - Arizona Individual Resident Income Tax Return (Long)

- Arizona Form 322 - Arizona Credit for Contributions Made or Fees Paid to Public Schools

- Arizona Form 323 - Arizona Credit for Contributions to Private School Tuition Organizations

- Arizona Form 140 Tax Tables - Arizona Resident Income Tax X & Y Tables

- Arizona Form 140PY - Arizona Individual Part-Year Resident Income Tax Return

- Arizona Form 140V - Arizona Individual Income Tax Payment Voucher for E-filing

- Arizona Form 204 - Arizona Application for Filing Extension For Individual Returns Only

- Arizona Form 321 - Arizona Credit for Contributions to Charities That Provide Assistance to the Working Poor

- Arizona Form 140EZ - Arizona Individual Resident Income Tax Return (Shortest)

Determine Your Residency Status

140ez Arizona 2014 Football

The amount of your taxes depends on your residency status, so check below to see which category you fall in.

You Are a Resident in Arizona

If you have a domicile home in Arizona, you are a resident in this state. If you are a resident and leave for a certain amount of time, you may still be considered a resident. As a resident, you are taxed on the same amount as the one you report on your federal return. You have to use Form 140 (or its shorter versions Form 140A and Form 140EZ) to file your return. To check if you are allowed to choose one of the shorter versions, check the 2019 Arizona Form 140 Resident Personal Income Tax Booklet, available for download above.

You Are a Part-Year Resident in Arizona

If you moved to or from Arizona in the last tax year, you are a part-year resident. You need to pay taxes on any income earned from Arizona sources, even income earned during the time when you were not a resident of Arizona. However, to avoid dual taxation, you can fill in Form 309 to claim credit for amounts paid as taxes in other states. To file taxes as an Arizona part-year resident, use Form 140PY (for more information you can download the 2019 Arizona Form 140PY – Part Year Resident Personal Income Tax Booklet above).

You Are an Arizona Resident Who Works in a Different State

140es Arizona 2019

To avoid double taxation if you are taxed by another state, use Form 309 to file in Arizona for a refund for taxes paid in another state. To file for your taxes as an Arizona resident who works in a different state, use Form 140 (check the 2019 Arizona Form 140 - Resident Personal Income Tax instructions, available for download above).

You Are a Nonresident Who Works in Arizona

If you are not a resident in Arizona, and earned an amount that exceeds the amount established by the state (see the Arizona Form 140NR Nonresident Personal Income Tax Booklet, available for download above), you have to file a tax return as an Arizona nonresident.

If you are also taxed by the state where you are a resident, you probably want to avoid dual taxation. Ask your state of residency about how you can be refunded for taxes paid in different states. You may also qualify for a tax refund in Arizona; to check if this situation applies to you, use Form 309.

140ez Arizona 2014 Election

If you are not a resident in Arizona, and sold property here, you may or may not be taxed on it. As the Arizona taxation system is based on the federal one, if you included the sale of the property on your federal return gross income, it will be taxed by Arizona. However, if it is not included on your federal return gross income, it will not be taxed.

To avoid dual taxation, ask the authorities in your state of residency for information on how to get a refund for the taxes paid to other states. In some situations, you may get a tax credit in Arizona as well; use Form 309 to see if this is the case.